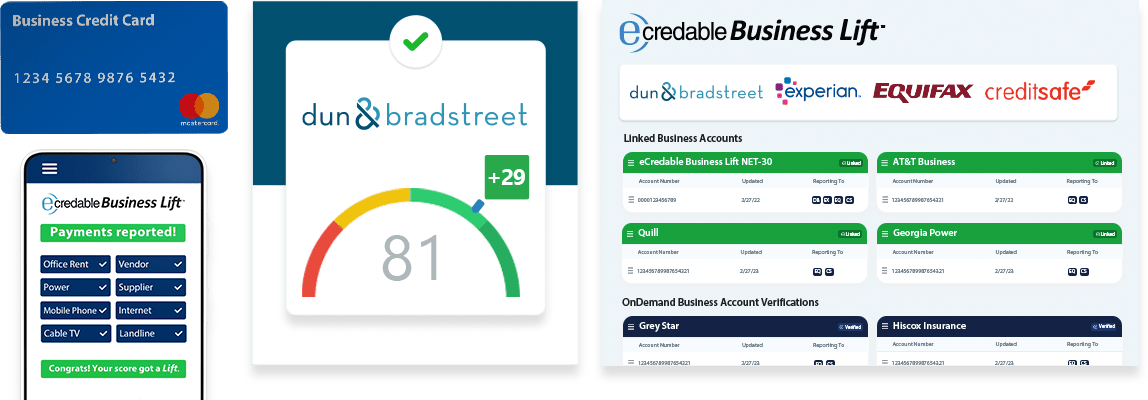

On-Demand Account Verifications

Please note that certain accounts can’t be linked and require an On-Demand Account Verification. You initiate this online, which is then completed over the phone, and can also report up to 24 months of payment history. You can request an On-Demand Account Verification at any time for $24.95 per account. This typically includes accounts such as:

Learn More

Learn More